In fact, New York municipal bonds of all stripes are getting thumped as investors brace for the full economic impact of Covid-19.

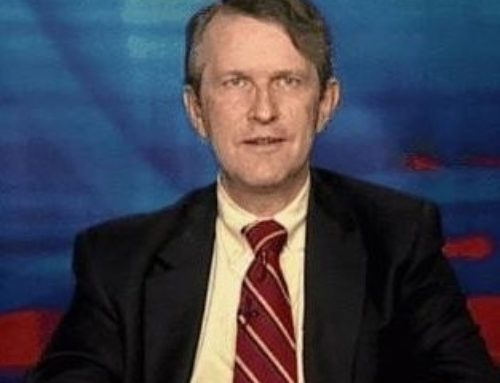

“The word I use is dystopian,” said Matt Fabian, a partner at Municipal Market Analytics, an independent research firm.

Muni bonds are ordinarily among the market’s safest investments, with a default rate of 0.18%, and New York’s bonds are considered best-in-class. The credit ratings for New York City and the state are both one notch below AAA, according to Moody’s, which on Feb. 20 praised the state for taking “proposed strong measures to correct its unfavorable spending trend.”

Plenty of people have incorrectly forecast doom before, but it’s also true that during the past several years the $3.8 trillion muni bond market has gone to help pay for more speculative developments such as ballparks, nursing homes and convention centers. The bonds are regularly used to pay for college dormitories, and now that universities have sent students home, those bonds look riskier.

That said, defaults are highly unlikely among big New York muni-bond issuers, such as the Metropolitan Transportation Authority or the Port Authority. Fares or tolls could be raised, and the government surely would step in to provide financial support if necessary. In the case of the Barclays Center, Moody’s says it has strong reserves and long-term contracted revenue, so it can pay bondholders even if the arena remains dark for a while.

But some of the new generation of muni-bond borrowers might have no choice but to default.

For instance, American Dream, the big new mall in East Rutherford, N.J., was paid for in part with $1.1 billion in municipal bonds. The mall, which had not fully opened yet, shut its doors Monday to help slow the spread of Covid-19. Fabian predicted the mall’s owners soon will be negotiating to restructure bond payments. He reckons owners of other struggling muni bond–backed enterprises will follow.