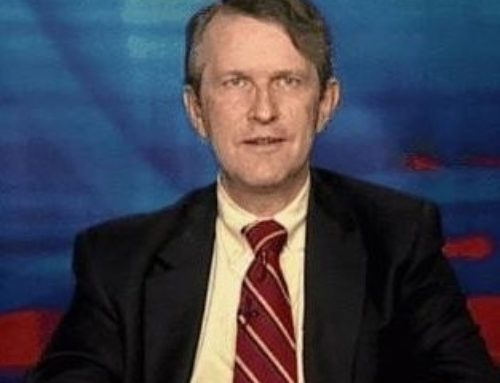

Ed Grebeck, CEO of Tempus Advisors had an interesting story to share that may be pertinent to the recent Sober Look post on the Goldman – Buffett transaction:

1999: gold price declining and volatile. GS approached me [Employers Re., a subsidiary of GE capital] with a transaction to hedge their exposure to 3 gold mines [These firms had sold gold forward to Goldman to hedge their gold production]: Ashanti [Ghana; largely owned by Anglo-American], one in Indonesia [previously part of OK Tedi Gold/copper mine] and another in Southeast Asia that escapes my memory. One of the three was fringe BBB/BB. Other two were solid B. These firms also had significant “emerging market” credit issues all around, and CDS in such markets would’ve cost mega bps.

Trying to address the counterparty risk on the forward contracts, GS came up with a solution: number crunch “joint probability of default” into synthetic (structured finance) tranche exposure. “We want you to sell protection on MEZZ TRANCHE… which as you can see from our painstakingly researched model is… solid BBB”… our pricing is “standard for BBB, plus [small, almost infinitesimal] premium”.

Goldman wanted to buy protection on these firms, but to make it cheaper, wanted protection for losses above a certain level on the portfolio of the three names (a mezz tranche CDS). And they were pricing it based on where standard BBB levels were at the time.

Ed Grebeck continues:

No serious mention of “liquidity… hedging ourselves”… other than “we [GS] don’t mind if you reinsure yourself … of course, we can help YOU hedge in cap mkts”.

I rejected outright — but I’m sure other P&C Re “convergence operations”… AIGFP (as well as other competitive silos within AIG), Swiss Re, Munich Re, names not in business today– ACEFS, St. Paul Re, Gerling Global, Centre etc etc … jumped at chance to “write premium for GS”.

IF GS risk management went berserk 1999 over relatively small counterparty exposure to physical gold producers, imagine what they must have thought in the summer of 2008, when they saw HUGE, UNCOLLATERALIZED exposure on 10 year + S&P index to Berkshire Hathaway

The conclusion here is that with Goldman’s focus on hedging all their exposures (based on internal policies), they must have been desperate to get some money out of Buffett to reduce their rapidly rising Berkshire risk (as the puts went deep into the money). It is therefore likely that Buffett was able to pressure Goldman into a transaction that was significantly skewed in his favor – not just because Goldman needed additional equity capital, but because they had to reduce their Berkshire exposure. This in fact provides additional support to a theory that Buffett took Goldman for a ride using his money losing short put positions as negotiating leverage.