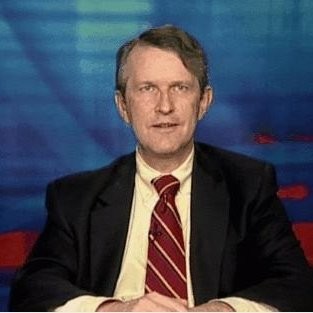

Edward Grebeck

In November 2007, Edward Grebeck delivered the first specific warning about systemic risk in the financial markets. Then, of course, came the 2008 crash.

Before this, after evaluating the fundamentals, he turned down a reinsurance deal with Enron ahead of its spectacular collapse in 2001 along with another one in Brazil before the country devalued its currency in 1999.

Now, Grebeck, who continues to provide prescient advice, has identified vulnerabilities in the municipal bond market that investors should heed, among other recommendations.

There’s a reason why his insights have appeared in Barron’s, Bloomberg, The Financial Times, The Wall Street Journal, and other top-tier outlets: “Ed is able to foresee developments six to nine months before they occur,” says Steven Levine, senior market analyst at Interactive Brokers.

One of the rare financial thought leaders to specialize in the capital and insurance markets, he uncovers underlying problems before they become issues and generates promising prospects even during times of political turbulence.

With an established, documented record uncovering mispricing, credit risk and rating agency complacency, Grebeck’s proprietary intellectual property helps investors, politicians, asset managers and corporate executives reduce risk and maximize returns.

Global debt market strategist

Experience

Chief Executive Officer

Tempus Advisors

2001 – Present

Instructor of Finance

New York University

2006 – 2009:

Managing Director

GE Capital

1998 – 2000

JPMorgan

Vice President

Chase Manhattan

1979 – 1984

Second Vice President

Chase Manhattan

1979 – 1984**

Senior Tax Accountant

Arthur Andersen

1977 – 1979

Education

Columbia Business School

MBA, Finance and Accounting

Cornell University

BS, Economics and Political Science

Publications: