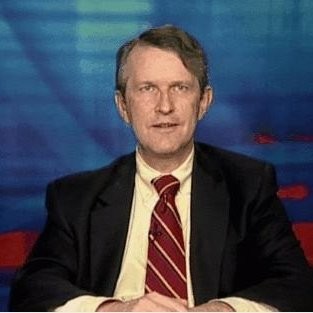

Edward Grebeck

Global debt market strategist

In November 2007, renowned global debt strategist Edward Grebeck delivered the first specific warning about systemic risk in the financial markets. Then, of course, came the 2008 crash.

Even before this, after evaluating the fundamentals, he turned down a reinsurance deal with Enron ahead of the company’s spectacular collapse in 2001 along with another one in Brazil before the country devalued its currency in 1999.

Now, Grebeck, a renowned global debt market strategist who continues to provide prescient advice, has identified vulnerabilities in the municipal bond market that investors should heed, among other recommendations.

There’s a reason why his insights have appeared in Barron’s, Bloomberg, The Financial Times, The Wall Street Journal, and other top-tier outlets: “Ed is able to foresee developments six to nine months before they occur,” says Steven Levine, senior market analyst at Interactive Brokers.

One of the rare financial thought leaders who specializes in the capital and insurance markets, Grebeck has amassed extensive expertise and experience building businesses and managing financial services teams at JPMorgan Chase and GE Capital, among others.

Living and working in volatile emerging markets – including South Africa during and after the fall of apartheid – fostered his commercial insight and historical perspective, which helps him uncover underlying problems before they become issues and generate promising prospects even during times of political turbulence.

A popular public speaker, he is a former financial journalist and instructor of finance at New York University. He also served as an expert witness in Manhattan federal district court concerning a project financing case.

Grebeck earned an MBA in finance and accounting at Columbia University and a BS in economics and political science from Cornell University.

With an established, documented record uncovering mispricing, credit risk and rating agency complacency, Grebeck’s proprietary intellectual property helps investors, politicians, asset managers and corporate executives reduce risk and maximize returns.

“Edward understands derivatives and their history.

He can convey to any audience their usage and the risks and rewards involved.”

“If there were a SEAL Team Six for finance, Ed Grebeck would be a charter member.”

Global Insights

The Emperors’ New Clothes?

November 7th, 2007 - Stamford, Ct The Emperors' New Clothes?: After the Credit Crunch, What's the Future of Structured Credit, Financial Guarantors and Rating Agencies? The Credit [...]

Sleepy municipal-bond market goes ‘dystopian’

With Barclays Center gone dark, about the only action left involving the arena can be found in, of all places, the bond market. Because it could be a [...]

U.S. Municipal Bond Market

In this course, IBKR senior market analyst Steven Levine provides essential details about the U.S. municipal bond market, including the types of securities investors typically encounter such [...]

NYU Shows us “How to Repair a Failed System”

NYU Stern recently presented a series of White Papers titled “Restoring Financial Stability: How to Repair a Failed System”. And how exactly does NYU plan to repair [...]

Did “hedge everything” policy push Goldman into a bad deal?

Ed Grebeck, CEO of Tempus Advisors had an interesting story to share that may be pertinent to the recent Sober Look post on the Goldman - Buffett [...]